When looking to invest in cryptocurrencies, it is important to consider a few key factors. Some of these include the platform’s security, its customer service, its user interface, and its trading volume. Additionally, it is important to research the platforms before making a decision.

Cryptocurrency exchanges

Top crypto exchanges are platforms where users can buy and sell cryptocurrencies. They allow people to trade digital assets for other digital assets or traditional fiat currencies. Cryptocurrency exchanges vary in terms of their features and layout, but they all require a user to register and provide personal information.

Memphis, there’s plenty to see. Read more about hubposts Click here tipsnews2day Touch here cartooncrazy Click here comeet Touch here newstweet

Most exchanges also require a deposit of some sort, which is often in the form of cryptocurrency or fiat currency. After registering and depositing money, users can start trading cryptocurrencies.

Platform’s features

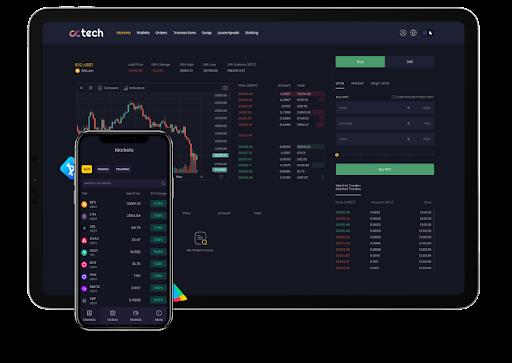

Cryptocurrency exchange software is essential for users of cryptocurrencies. They allow for the buying and selling of digital assets and provide an interface between users and the blockchain. Cryptocurrency exchanges vary in terms of features and functionality, but all share a key factor in common: they are designed to allow users to trade cryptocurrencies.

The most popular cryptocurrency exchanges are based on a model known as “wallet-to-wallet” trading. This allows users to exchange cryptocurrencies with other people directly from their wallets. Other popular models include “marketplace” exchanges, which allow users to buy and sell cryptocurrencies without having to hold any of them themselves.

Some exchanges offer advanced trading features such as margin trading, stop orders and day trading. These allow traders to make more substantial profits by riskier investments.

Market liquidity

One important factor to consider when choosing an exchange is the market liquidity. Market liquidity refers to how many cryptocurrencies are available for purchase or sale at any given time. The more liquid an exchange is, the more easily buyers and sellers can find each other and make transactions. A highly liquid exchange is key to making informed decisions about which cryptocurrency to invest in or trade with.

Customer Service

It is important to choose an exchange with excellent customer service. This is because bad service can lead to disgruntled customers who may not be willing to use the exchange again in the future. Furthermore, poor customer service can also lead to lost funds due to technical issues.

Security

It is essential that an exchange has strong security measures in place. This includes features such as two-factor authentication and a secure login page. If an exchange fails to meet these standards, it could be vulnerable to cyberattacks.

Coins and tokens Available

When selecting an exchange, it is important to consider the variety of coins and tokens available. Some exchanges offer only a few cryptocurrencies, while others offer dozens.

Trading volume

Trading volume is one of the most important factors to consider when choosing a cryptocurrency exchange. The higher the trading volume, the more liquidity there is in the market and the easier it is to buy or sell cryptocurrencies. It’s also important to look for exchanges with high liquidity levels so you can easily trade cryptocurrencies without experiencing delays.

Fees

Another key factor to consider when choosing a cryptocurrency exchange is fees. Exchange fees can impact your overall returns on investment (ROI). Look for exchanges with low fees so you can make more money while trading cryptocurrencies. Many exchanges also offer discounts for bulk transactions.

Cryptocurrency exchange script

Cryptocurrency exchange scripts are an essential part of any cryptocurrency trader’s arsenal. They allow traders to automate the process of buying and selling cryptocurrencies, which can save a tremendous amount of time and money. There are a few key factors to consider when choosing a cryptocurrency exchange script.

First, the cryptocurrency exchange script should be user-friendly and easy to use. Second, the script should have features that allow for advanced trading functionality, such as order book management and market analysis tools. Finally, the script should be reliable and secure. If you’re looking to add a cryptocurrency exchange script to your trading arsenal, be sure to research carefully before selecting a provider.

Conclusion

In conclusion, it is important to consider a few key factors when choosing a cryptocurrency exchange: security, accessibility, fees, trading options, and supported cryptocurrencies. It is also important to make sure the exchange has a strong reputation and is well-maintained. Overall, choosing the right cryptocurrency exchange can be critical to your success as a digital trader.